The new digital economy in Latam

May, 08, 2023

10 min. reading

The Airtm dollar account was founded seven years ago to help citizens living in unstable Latin American economies preserve their wealth. Our time pushing the mission forward gave us a new perspective on the barriers to financial freedom. Restrictionless access to stable currency can only go as far as people can afford to buy it: unemployment and devaluation make that an impossibility for most. True financial freedom can only come from being able to generate a livelihood independently of your distressed country’s ability to provide for you. In this post we aim to describe Airtm’s strategic focus shift to financial independence.

Some context on our origin

The company, as an idea, was first conceived while working at a bitcoin startup in San Francisco, Uphold. As interns trying to learn from early bitcoin adoption, we were quick to learn about the “store of value” use case in Argentina. Being faced with 50yr+ hyperinflation and currency controls, Argentinians had normalized dealing in the blue (black) dollar market. They were quick to adopt bitcoin and the then famous LocalBitcoins over-the-counter (OTC) bitcoin trading platform as a more democratic alternative to the analogue solution. Even back then, bitcoin was a volatile asset though. Using Uphold’s early stablecoin tech, and taking note of these restrictive trends, we decided to launch Airtm in July 2015.

Our solution to Argentina’s capital controls was a simple dollar account conjoined to a peer-to-peer dollar trading marketplace. An individual could open an Airtm account and use it like a checking account. All deposits and withdrawals were done through our marketplace where a user could exchange local currency for USDC (learn more about USDC here) with another user at the free market rate. In other words, just like an Uber driver helps you move from one place to another, an Airtm peer will exchange your currency for their USDC and back to local currency to help you add and withdraw funds.

The business did well in Argentina but exploded in Venezuela, our second expansion market. Draconian economic restrictions and an average 50% monthly inflation drove sign ups through the roof. By 2017 our exchange rate had even become the most popular in the whole country. Our success didn’t go unnoticed. Venezuelan dictator Nicolás Maduro threatened to shut our company down on national television, calling us financial terrorists and foreign agents. The government even had police squads raid the homes of our local team members in an effort to intimidate and terrorize our team. His efforts backfired. An informant helped us get our team to safety and Maduro validated our rebel cause in local eyes and pushed us to look for growth opportunities outside of distressed economies.

After all, every Latin American looks to the dollar when thinking about wealth preservation but only a few have access to dollar accounts locally.

After years expanding our democratic wealth preservation tool in Mexico, Colombia, and Brazil, we began questioning Airtm’s impact. Giving people the ability to hedge against local currency devaluation was important, yes, but only to the people lucky enough to have disposable income or savings which to preserve at the end of the month. Could we provide a solution to low wages and growing unemployment though?

In Latin America, when our government fails, we fail

We have to qualify the following statement by saying we are not economists, but rather entrepreneurs. We look at problems and propose solutions. We believe that one of the largest problems facing our people is our high dependency on our government’s ability to provide stability and prosperity for us. When our government fails, we fail. So, why not aim to become financially independent from our country?

Roughly one third of Latin Americans live below the poverty line and another third earning $13 to $70 per day constitute the middle class. The Covid-19 pandemic hit Latin America especially hard. The regional economy contracted an average of 7% while 34+ million jobs were lost (The Economist/ECLAC). It is a rough time for our people and the outlook is not good with global uncertainty driving demand for dollars up and the perceived value of our local currencies down.

Political instability has led to increased migratory flows in the Americas. Folks, eager to improve their living conditions, are risking their lives for a shot at the American Dream even as borders become tighter. Data from 2020 indicates that more than 32 million Latin Americans live outside their country of origin. Mexicans make up 25% of the migrant population in the United States and Latin Americans make up another quarter (Pew Research Center). The number of children migrating from this region and the Caribbean is projected to hit 3.5 million this year, a 47% increase compared to 2020 (UNICEF). Migration flows have become widespread in the entire Western Hemisphere.

Migration in Latin America is a clear reflection of our government’s inability to provide opportunities for us. Well, migration is growing. What do you think that says about our local situation? Would you leave your success in the hands of a local Latin American government? So, why not aim to become financially independent from our country? That is where the digital economy comes in, and the growing ability of Latin Americans to make a living by working online. We don’t have to sit and wait for our country to generate enough jobs. We don’t have to migrate in search of employment.

The digital economy, a bridge to financial independence

Web 2.0 platforms and cross border payments catalyzed a thriving digital economy. Every day more income-generating opportunities surface online creating more opportunities. Millions are already thriving as digital entrepreneurs i.e. freelancers, microtaskers, retail investors, content creators, gamers, online merchants among many other occupations. Rising internet penetration, relatively low salary expectations, and the ease with which one can learn a trade online have also made it easier for people in our region to join the online workforce. People throughout the developing world, let alone Latin Americans, no longer have to conform to the opportunities their country can offer. They can take charge of their financial stability and security simply by going online.

Proposing that the digital economy could end forced migration would be an overly simplistic view on Latin American problems. After all violence and food insecurity drive people away from home as much as poverty (worldvision.org). Furthermore, digital jobs can’t get to people without access to the internet. Clearly local governments need to step up. We do believe however, that a large portion of the digital economy remains grossly underdeveloped and could be expanded given the proper conditions and economic incentives.

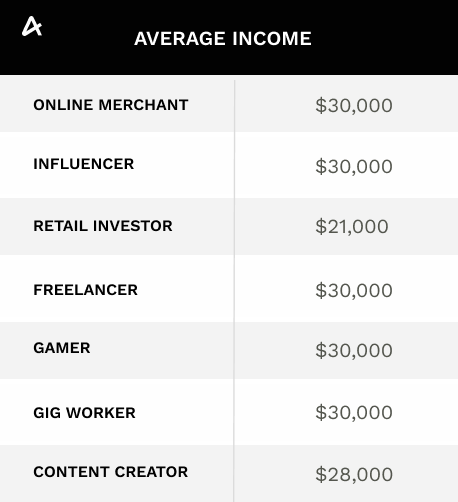

Unemployment rates in Latin America lie at 10% on average (The World Bank). In addition, average online work earnings are quite high in comparison to local salary expectations. The gross yearly income per capita in Latin America is around $7,771 (ECLAC). The minimum expected yearly earnings for a digital entrepreneur in America range is around $28,000 (Annex 1). Becoming part of the digital economy is a huge opportunity for a Latin American, especially for those in most need.

Without proper cross border payment infrastructure, however, could an industry be built around a lower income workforce? If you can’t pay them, why even consider building a business that revolves around them let alone an industry?

Annex 1: Estimated earnings per digital entrepreneur segment (comparably.com).

The chicken and the egg problem

(Yes, the digital economy has one of those too.)

There is surely someone out there in Venezuela willing to design that logo for five bucks, but how would you pay them? Maybe you could use a major e-wallet? Major e-wallets, though, collect an average $5 + 6% fee at the time of cashout, which by the way also takes six days to process! SIX DAYS!!! If you can’t pay them in a way that makes sense for them, why would they even work for you? This is the chicken and egg problem deterring the digital economy from reaching far and wide the developing world.

Remember that marketplace we talked about in the first section you might have skipped over? Today, it’s present in every country in Latin America and can deliver digital dollar payments at a $0.40 + 3% fee on average in about 6 minutes (see annex 2 for per country fees). Our cross border payment rails are available for American consumers like you to pay anyone $5 for your awesome new logo anywhere in the developing world. They are mainly used by large enterprises such as Scale, however. They and several others use Airtm’s enterprise solutions to deliver mass micro cross border payments to their digital entrepreneur workforce in Latin

America and other developing world countries.

Annex 2: Airtm’s average withdrawal fees.

With the proper cross-border payment systems in place, the current web 2 platforms, even the nascent web 3 platforms, could broaden their reach. On one side, they could offer cheaper demand side prices, and on the other, opportunities to Latin Americans and others seeking financial independence. Our hope however, is for Airtm to lay the foundation of a new digital economy in a similar way as PayPal laid the foundation for the thriving digital economy today. By enabling cross border micro transactions we believe that entrepreneurs around the world will be able to generate net new forms of value creation and opportunities for millions of people throughout the developing world.

Liberating Latin American potential

Airtm began with a retail wallet, expanded to cross border payment disbursement as a way to help Latin Americans earn money in a way that worked for them. Going into the future, you can expect us to continue investing in more financial services for enterprises and consumers to exchange value amongst each other. E-commerce enablement and payment processing are other critical cross border payment tools we envision to create. But more than just technology, Airtm aims to power a brand new economy.

On one side enterprises will join this new economy creating earning opportunities. On the other side, people in need will come online to fulfill demand for their value creation. There are already more than 3m Airtm account holders, most of them Latin Americans subjugated by their countries’ precarious situation. Our enterprise team is already working tirelessly to help them thrive by giving them access to new income-generating opportunities.

Annex 3: Macroeconomic data from different world regions (World Bank).

We write this post in the wake of our new brand launch. Our new brand revolves around the concept of a prism. A prism receives light and refracts it into a mesmerizing rainbow. Similarly, at Airtm we aim to receive Latin America and other developing world regions and transform them into vibrant economies. Ones where financially independent people are able to thrive thanks to their fluid access to their global economy. One where financially independent people, not their governments, make the developing world shine.

Follow us for more updates on the Airtm mission. If you or your company would like to join the new digital economy, please let us know [email protected].